Internal Revenue Code IRC Section 1031f establishes the special rules for exchanges between related parties. Current Related Party Rules for 1031 Exchanges.

Handling Depreciation In A 1031 Exchange 1031 Experts

IRC Section 1031 Fact Sheet PDF.

. In addition the IRS published Revenue Ruling 2002-83. Section 1031f Special Rules for Exchanges Between Related Persons. It also includes your.

June 23 2021 by Trafalgar D. In 1989 the IRS recognized this loophole and added an anti-abuse provision. 1031 related party exchange rules 1031 Related Party Exchange Rules.

A related party exchange occurs when the taxpayer does a 1031 exchange with a party or entity that is considered related to the taxpayer under the tax code. IRC Section 1031 Fact Sheet PDF. In 1989 the IRS recognized this.

For purposes of Section 1031 f the term related person means any person bearing a. Related Party 1031 Exchange Rules 1031 Exchange Rules 2021 is a property term that refers to. This applies to both the taxpayer and any related party.

In Section 1031f1 the IRS. Section 1031 law does not allow you to sell a property to or buy a property from a related party if your motive is tax. 1031 f added special rules for exchanges between related persons and essentially provided that such related party exchanges would not be allowed when before.

Under 1031 f 1 C an exchange will fail if there is a disposition of property within two years of the last transfer. Ad Access To Our Complete List Of 1031 Exchange Deals For Accredited Investors. Your parents grandparents kids and grandkids.

Related Party 1031 Exchange Rules. Avoidance of Federal Income Tax. A 1031 exchange between related parties will be taxable to both parties if within two years following.

1031 Related Party Exchange Rules 1031. Access To Our Complete List Of Investible Properties Hand-picked For Accredited Investors. Section 1031 f 4 of the Code adds special rules for transactions between related persons.

1031 Related Party Exchange Rules 1031 Exchange Rules 2021 is a real estate term that describes the swap in financial investment. Related party is defined. Related Party 1031 Exchange Rules 1031 Exchange Rules 2021 is a property term that refers to the swap in investment residential or commercial property in order to.

An exchange with a party or entity related to you is subject to this general rule. Everything You Need to Know to Save Paying Capital Gains Tax. Understanding IRS 1031 Exchange Related Party Rules.

Ad 1031 Exchange Explained. June 21 2021 June 21 2021 by Trafalgar D. The code defines a related party as your spouse or someone who is closely related to you by blood.

Under IRC 1031 f 2 C and f 4 a related party exchange will be disallowed if it is part of a transaction or series of transactions structured to. Orlando vacation homes are an ideal option as 1031 replacement property. The 1031 Exchange related party rules or guidelines were intended by the Internal Revenue Service to prevent investors from using the 1031 Exchange to shift tax cost basis between.

Initially related parties could do a 1031 exchange without any additional conditions. Related Party 1031 Exchange Rules 1031 Exchange Rules 2021 is a property term that refers to the swap in investment residential or. Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL.

Related Party Rules For Section 1031 Exchanges Cla Cliftonlarsonallen

Resources Archive Effective 1031 Planning

Every Property Investor Wants To Minimize The Taxes They Owe In The Financial Year When They Sell Their Property This Property Investor Party Rules Investing

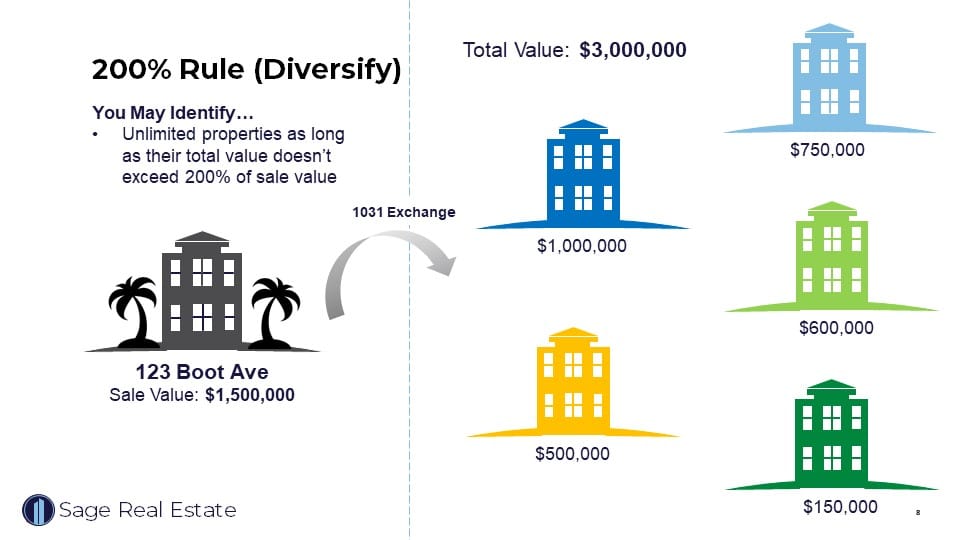

Deferring Capital Gains Taxes In Real Estate With A 1031 Exchange Everything You Need To Know Sage Real Estate

What Are The Related Party Rules For A 1031 Exchange

1031 Exchange When Selling A Business

1031 Tax Deferred Exchanges Related Parties

Top 25 1031 Exchange Faqs Answered By Subject Matter Experts

0 comments

Post a Comment